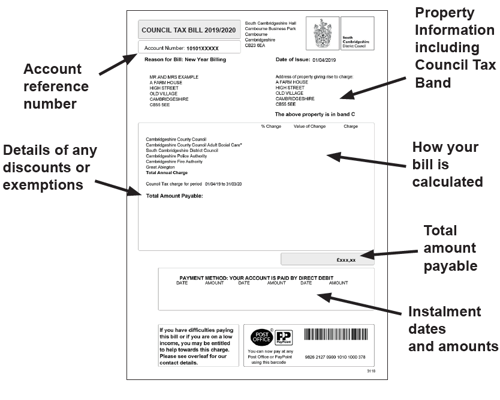

Understanding your Council Tax bill

There is one Council Tax bill per property whether it is owned or rented, and the people that live in the property would normally have to pay. The amount charged depends on the Council Tax Band of the property, which is allocated by the Valuation Office Agency (VOA) according to the open market value at 1 April 1991. This information can be found in the table below. If you have reason to think your band may be wrong, you can appeal to the Valuation Office Agency. You must continue to pay until any appeal is decided. You can also call them on 03000 501 501.

Please check your bill carefully to make sure all the details are correct. If you have had a change in your circumstances which may affect your entitlement to any reduction, discount or exemption, you must let us know within 21 days, otherwise you may have to pay a penalty.

Valuation Band |

Range of Values £ |

Proportion of Band D Tax Payable |

|---|---|---|

| A | Up to and including £40,000 | 6/9 |

| B | £40,001 to £52,000 | 7/9 |

| C | £52,001 to £68,000 | 8/9 |

| D | £68,001 to £88,000 | 1 |

| E | £88,001 to £120,000 | 11/9 |

| F | £120,001 to £160,000 | 13/9 |

| G | £160,001 to £320,000 | 15/9 |

| H | More than £320,000 | 2 |

Disabled Band Reduction Scheme

If you or someone that lives with you is disabled and you have a second bathroom, kitchen or other room to meet their needs, you may be entitled to a reduction equivalent to one Council Tax Band.

These reductions ensure that disabled people do not pay more tax on account of the space needed because of a disability. If your home has any special fixtures that have been added for a disabled resident which may affect the overall value of the property and you don’t think this has been taken into account in the valuation band, please contact the Valuation Office Agency.

If you feel you might qualify for a discount, please visit our Disabled Band Reduction page for more information.

Discounts, Exemptions and Reductions

Eligibility for discounts, exemptions and reductions depend on individual circumstances, and broad examples are shown below. If you think any of these may apply to you or someone you know, please contact us as soon as possible.

In addition to the discounts and exemptions shown, the Council also has discretion to reduce the amount of Council Tax payable for situations that are not covered by national discounts and exemptions. This can be used for individual cases, or to locally determined classes of property.

Am I entitled to a Discount?

The Council Tax bill assumes that there are at least two adults living in a property, but if there is only one adult living in a property as their main home they can apply for a 25% discount. If there is more that one adult living in a property, other adults may not be counted for Council Tax if they are:

- Full-time students, student nurses or apprentices

- Members of visiting forces or certain international institutions

- Being looked after in care homes

- Severely mentally impaired

- Staying in certain hostels or night shelters

- In prison (except those in prison for non payment of Council Tax or a fine)

- 18 and 19 year olds at or just left school where child benefit is still in payment

- Caring for someone with a disability who is not their spouse, partner or child under 18

- Permanently resident in hospital

- Some care workers, usually for charities

- Members of religious communities, such as monks or nuns.

Other discounts may apply where:

- The property is uninhabitable as a result of being in need of or undergoing major structural repair

- The property is an annexe which is used as part of the main property.

- You have to live elsewhere as a condition of your job.

Empty properties and Second Homes

Under a local scheme set by South Cambridgeshire District Council, there is no discount for empty properties or second homes.

For those properties that have been empty and unfurnished for more than two years, an extra 100% charge applies.

From the 1st April 2020, properties that have been empty and unfurnished for more than 5 years will have an extra 200% charge applied.

Please visit our Information Page for more information and to find out about increases in future years.

Should my property be Exempt?

|

Exemption Class |

An Unoccupied Property that is: |

|---|---|

|

B |

Owned by a charity (exempt for up to 6 months) |

|

D |

Left empty by someone who has gone to prison |

|

E |

Previously occupied by a person now in permanent residential care |

|

F |

Empty where the liable person/owner has died and the executors or personal representatives are now liable (exempt for up to 6 months from grant of probate) |

|

G |

Empty because occupation is forbidden by law |

|

H |

Waiting to be occupied by a minister of religion |

|

I |

Left empty by someone who has moved to receive care by reason of old age, disablement or illness |

|

J |

Left empty by someone who has moved to provide care to another person |

|

K |

Owned and last occupied by a student |

|

L |

In possession of the mortgagee |

|

Q |

The responsibility of a bankrupts’ trustee |

|

R |

A site for an individual caravan, mobile home or mooring |

|

T |

Linked to, or in the grounds of another property and may not be let separately due to planning restrictions |

|

- |

An Occupied Property where: |

|

M/N |

All the residents are students |

|

P |

At least one liable person is a member of a visiting force. |

|

S |

All the residents are less than 18 years of age |

|

U |

All the residents are severely mentally impaired |

|

V |

At least one liable person is a foreign diplomat |

|

W |

The property is annexed to a family home and occupied by that family’s elderly or disabled relatives |

If you think you might qualify, please visit our Reductions and Discounts page for more information and to apply.

What if I am on a low income?

We operate a Local Council Tax Support scheme, where residents on low incomes can access financial support towards their Council Tax bill. Full details of the scheme, along with an electronic application form, can be found under Benefits.

Is your bill correct?

Please check your bill carefully to make sure all of the details are correct. If you have had a change in your circumstances which may affect your entitlement to any reduction, discount or exemption, you must let us know within 21 days, otherwise you may have to pay a penalty.

If you disagree with the charge, for example, you believe a discount should apply or you are not the liable person, you must contact us. Following consideration, if the decision is not changed you can appeal to the Valuation Tribunal.

Parish Council Tax expenditure

As part of the South Cambridgeshire District, we have number of Parish councils that also have yearly expenditure based on required outgoings that contribute to the community and local services. The yearly amount given to local services by each Parish council is recorded in a leaflet for distribution and transparency.

The leaflet shows the amount of Council Tax due for each property in South Cambridgeshire.

The baseline for the figures are for an average Band D property charge and are made up of the amount required from:

- The Parish Council

- South Cambridgeshire District Council

- Cambridgeshire County Council (General)

- Cambridgeshire County Council (Adult Social Care)

- Cambridgeshire Police and Crime Commissioner

- Cambridgeshire Fire Authority

The amount of Council tax payable per property is then determined by the Valuation Band of your property.

View the Parish expenditure Council Tax leaflet for 2023 to 2024. [XLSX, 49Kb]

View the breakdown of costs for Parish expenditure over 140k. [XLSX, 21Kb]