Our Investment strategy

The Investment Strategy has been approved by Full Council and enables us to invest in opportunities and assets to generate income to reinvest in its services.

An introduction to our investment strategy

The Local Government Act 2003 (the Act) and supporting regulations requires us to ‘have regard to’ the following:

- The Chartered Institute of Public Finance and Accountancy (CIPFA) Prudential Code

- The CIPFA Treasury Management Code of Practice (the Code) and Investment Guidance (the Guidance)

These are issued by The Ministry of Housing Communities and Local Government (MHCLG) to ensure that our capital investment plans are affordable, prudent and sustainable.

In February 2018 the Secretary of State issued new guidance on Local Government Investments (the Guidance). This widened the definition of an investment to include all the financial assets of a local authority as well as other non-financial assets, held primarily or partially to generate a profit. This wider definition includes investment property portfolios as well as loans made to wholly owned companies or associates, joint ventures or third parties. The Guidance applies for financial years commencing on or after 1 April 2018.

The Guidance requires the Investment Strategy to be approved by Full Council on an annual basis and sets out the disclosure and reporting requirements. Any mid-year material changes to the Strategy will also need to be subject to Full Council approval.

We have set out within this Strategy its approach to risk and risk mitigation. This includes the requirement for fully tested and scrutinised business cases, sound due diligence indicators, the need for regular and formal reporting and the effective scrutiny of investment decisions and performance.

The investment strategy

- South Cambridgeshire is located centrally in the East of England region at the junction of the M11/A14 roads and with direct rail access to London and to Stansted Airport. It is a largely rural district which surrounds the city of Cambridge and comprises over 100 villages and 1 town, none currently larger than 8,000 persons. It is surrounded by a ring of market towns just beyond its borders, which are generally 10–15 miles from Cambridge. Together, Cambridge, South Cambridgeshire and the Market Towns form the Cambridge Sub-Region. South Cambridgeshire has long been a fast growing district and in 2011 had a population of 146,800 persons (bigger than Cambridge itself) and has become home to many of the clusters of high technology research and development in the Cambridge Sub-Region.

- The Council recognises that it faces a unique set of challenges to deliver the services and infrastructure required to support the new communities on the strategic growth sites within the Greater Cambridge area, where the District will see the majority of the 22,000 jobs and 19,500 homes to be delivered between 2011 and 2031. To meet this challenge, against further funding uncertainty from central government to deliver essential services, the Council has recognised the need to make investments to ensure it has the capacity to continue to grow and deliver essential services.

- The Council has taken independent advice during the development of the Strategy and continues to engage with commercial advisors and regulators to ensure that its officers and members are engaged in continual professional development in relation to property investment activities by local authorities.

Aims: The Investment Strategy aims to provide a robust and viable framework for the acquisition of commercial property investments and the pursuance of redevelopment and regeneration opportunities that contribute to Business Plan objectives and can deliver positive financial returns for the council.

Value: The Investment Strategy identifies the sum of £340 million for prime and close to prime commercial real estate investment, investment which can generate regeneration or economic development benefits as well as positive financial returns for the Council and for investment partnerships with third party developers to deliver new homes. These streams of investment are outlined in more detail at Section 7. The Strategy also covers the existing portfolio of investments comprising of the following loans to third parties:

- A loan to Cambridge Ice Arena with a value of £2.5 million for a term of 25 years at a rate of 4.31%. The interest cost for the loan is based on a PWLB rate of 2.56% plus a margin of 1.75%;

- Loans to South Cambs Ltd (Trading as Ermine Street Housing) with a value of £63.317 million (at September 2019) at a rate of 3.78% (reviewed annually). The Council earmarked a total investment of £100 million to Ermine Street in its capital programme to enable the supply of 500 private rented housing stock; loans are based on an opportunity cost of 1% plus a margin of 2.78%.

Contribution: The Council invests in local commercial property with the intention that profits will be spent on local public services. The following table provides details of the current portfolio:

|

Total |

13,000 |

|

Category |

Fair Value £000 |

|---|---|

|

Commercial |

13,000 |

|

Offices |

0 |

|

Retail |

0 |

|

Industrial |

0 |

|

Ground Lease |

0 |

|

Agriculture |

0 |

|

Other |

0 |

Security: In accordance with government guidance, the Council considers a property investment to be secure if its accounting valuation is at or higher than its purchase cost including taxes and transaction costs. A fair value assessment of the Council’s investment property portfolio has been made within the past twelve months, and the underlying assets provide security for the capital investment. Should year end accounts preparation and audit processes value these properties below their purchase cost, then an updated Investment Strategy will be presented to Council detailing the impact of the loss on the security of investments and any revenue consequences arising therefrom.

Financing the Strategy: The Council will fund the investment property acquisitions by utilising the most appropriate and efficient funding strategy available at the time of purchase. The Council has the option of utilising prudential borrowing, capital receipts, and reserves and may consider other structures such as joint ventures with pensions and insurance funds. Financing decisions will link to the Council’s Medium Term Financial Strategy and Treasury Management Strategy.

Risk Assessment: The Council assesses the risk of loss before entering into and whilst holding property investments. The Council is engaged in the market through the proactive management of the investment portfolio, the asset valuation exercise and the economic growth activity and, through this, gaps/opportunities in the market are identified. Each asset is reviewed on an annual basis in order to review its performance, investment requirements and whether it should remain in the portfolio. The Council intends to adopt a risk spread profile but its commercial portfolio is, at this stage, limited and not diversified (see table at 2.6 above). It is recognised, therefore, that the Council is potentially exposed to greater risk in the early period of the Investment Strategy through the absence of diversification. As the portfolio develops, there will be a need to assess the continuing appeal of the Council’s property investments in the market. In some property investment classes this could be more significant than others, for example functional obsolescence in the industrial sector may have less impact on market appeal and rental growth than in the office sector. Economic obsolescence risk may be higher in markets which are more susceptible to social change and popular culture.

The Head of Commercial Development & Investment is responsible for ensuring that each investment decision is measured against the investment criteria set out in the Investment Strategy, which includes an assessment of risk. Asset investment advice is provided by retained agents and, where necessary, additional specialist advice is procured from suitably experienced external advisers. This will include the provision of pre-purchase reports and building surveys and other due diligence required to support the business case. The advice by the retained agents will include an assessment of the market and how it will evolve over time, the nature and level of competition and the impact that any asset acquisition or disposal could have on the projected income generated. The retained agent advice is monitored against the specification of requirements detailed in the invitation to tender and contract.

Liquidity: Compared with other investment types, property is relatively difficult to sell and convert to cash at short notice and can take a considerable period to sell in certain market conditions. The Council has no immediate plans or needs to sell any of the property investment assets. However, lower yielding assets may be sold and replaced with higher yielding assets within manageable risk tolerances.

Loan Commitments: Although not strictly counted as investments, since no money has exchanged, loan commitments and financial guarantees carry similar risks to the Council. The Council has no such loan commitments or financial guarantees.

Proportionality

In setting a balanced budget (as required by statute) the Council takes into account the contribution of income that is generated by its investment activity and, in doing this, it recognises that such investment activity meets wider economic and service objectives of the Council. The table below shows the extent to which expenditure planned to meet the service delivery objectives and/or place making role of the Authority is funded by the expected net income from investments over the lifecycle of the Medium Term Financial Strategy.

|

Proportion |

0.17 |

0.30 |

0.44 |

0.58 |

0.69 |

|

Investment Net Rate of Return |

2019/2020 Budget £000 |

2020/2021 Budget £000 |

2021/2022 Budget £000 |

2022/2023 Budget £000 |

2023/2024 Budget £000 |

|---|---|---|---|---|---|

|

Net Revenue Stream |

18,590 |

15,651 |

16,262 |

16,479 |

16,528 |

|

Net Investment Income |

3,238 |

4,765 |

7,148 |

9,533 |

11,372 |

Note: The Net Revenue Stream will need to be updated in line with future medium term financial forecasts.

An appropriate level of contingency within the General Fund Reserve is assessed annually as part of the outturn position each year. The Council also has a contingency revenue allocation of £75,000 to cover specified “precautionary” items. These contingencies cover any net reduction in income sources, including rental income from investment properties, compared to the levels estimated.

Borrowing in Advance of Need

Government guidance is that local authorities must not borrow more than, or in advance of their needs, purely in order to profit from the investment of the extra sums borrowed.

Where exceptionally the Council chooses to disregard the CIPFA Prudential Code and Government Guidance in respect of borrowing to fund investment activity, the rationale for this decision must be explained in the Strategy.

The Council has noted and has had regard to the Guidance and has no plans to borrow in advance of need and is, therefore, compliant with the CIPFA Prudential Code in respect of this matter. The Council will only depart from it in exceptional cases, within the parameters set out in this Strategy, for the purposes of delivering Business Plan objectives and maintaining a robust financial position. In these exceptional cases, the reasons for so doing will be fully explained, together with the Council policies for investing the money borrowed, including management of the risks, for example, of not achieving the desired profit or borrowing costs increasing.

Capacity, Skills and Use of External Advisors

The Guidance requires that elected members and officers involved in the investment decision making process have appropriate capacity, skills and information to enable them to take informed decisions whether to enter into a specific investment. In addition, it places a duty on us to ensure that advisors negotiating deals on behalf of us are aware of the core principles of the prudential framework and the regulatory regime in which we operate. This will be achieved by ensuring an adequate and effective training programme, obtaining appropriate advice to inform the decision making process and by ensuring that procurement arrangements provide relevant information to potential advisors of the specific principles, regulations and governance relevant to the local authority sector.

We will appoint specialist advisors to provide training to ensure that relevant Officers and Members have the required skills to make informed decisions and assess the associated risks. This training will take place before any investment decisions associated with the Strategy are considered and on a regular basis to ensure that Officers are engaged in continual professional development in relation to property investment activity and that Members, as decision makers, have the skills, knowledge and relevant information to effectively assist the decision making process. This will include training for new Members of the Council.

We recognise that investing in land and properties to achieve business objectives and to generate returns is a specialist and potentially complex area. We employ professionally qualified and experienced staff in senior positions with responsibility for making capital expenditure, borrowing and investment decisions. Where skills, or capacity are lacking, we will engage the services of professional property, legal and financial advisors, where appropriate, to access specialist skills and resources to inform the decision-making process associated with this Strategy. We measure the impact of investment decisions on borrowing and affordability through Investment Indicators to ensure that the overall risk exposure remains within acceptable levels.

Governance Arrangements

It is necessary to have a framework for determining which properties and development opportunities should be invested in.

A designated Investment Selection Team (IST), structured as outlined in Appendix 4, provides the setting for senior property, finance, service and legal professionals to share details of investment proposals ensuring that the core principle of the CIPFA Prudential Framework and the regulatory regime within which we operate are adhered to.

The IST will advise a designated Investment Governance Board (IGB) on potential purchases and development opportunities that meet the pre-determined selection criteria contained within the Investment Strategy. The IST will identify investment opportunities based on the selection criteria set out in this Strategy, will carry out all necessary due diligence and will present a full business case to the IGB for The structure of the IGB is also outlined in Appendix 4. The purpose of the IGB is to challenge and scrutinise investment opportunities identified by the IST, ensuring that only credible options are progressed. It also provides the forum for the strategic management of the overall portfolio of investments, consistent with the aims of the Strategy.

Investment decisions taken by Cabinet will be subject to the fulfilment of the minimum criteria set out within the Strategy, satisfaction with the business case and risk assessment, and will have regard to the recommendation of the IGB. Acquisitions and development opportunities that do not meet the minimum criteria set out within the Strategy may still be considered, where they would bring other compelling benefits to the District, but would require Cabinet approval.

Cabinet is required to approve investment in new capital schemes prior to any expenditure being incurred (subject to 6.6 below) and Council approval will be required if additional, or the re-profiling of, funding is required. There may be occasions when an investment opportunity may be lost by the market need for speed; in these exceptional cases, decisions may be taken by the Leader after consultation with IGB and in accordance with the Access to Information Procedure Rules as set out in the Constitution and a full report will be prepared to inform the decision, fully outlining the opportunities and risks. The requirements relating to the giving of notice of the decision in the Forward Plan and for call-in of any decision shall apply unless the urgency procedures in our Constitution are required to be used for urgent investment decisions.

To enable the timely and decisive decision making which is essential in this type of industry, to respond to opportunities as they arise, regular meetings of the IGB will be scheduled. Our Scheme of Delegations provides the basis for enabling Officers to progress investment opportunities, including due diligence checks and the submission of non-binding offers in line with market practice.

Investment Streams

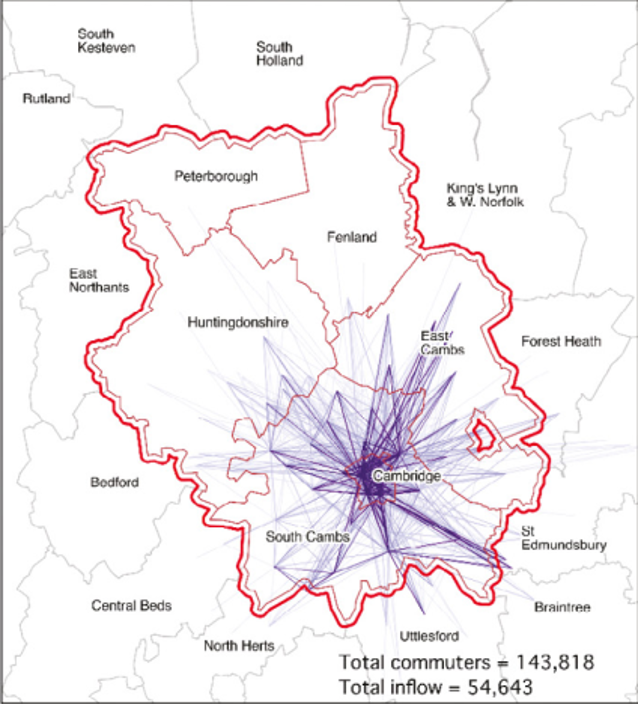

Investments will be focussed within the District, the Greater Cambridge Partnership area and the Travel to Work Area as shown in Appendix 5.

The Investment Strategy identifies the sum of £340 million for potential commercial investments into three streams of activity outlined in 7.3 below. This provides (i) an allocation for Stream 1 investments in line with the potential investment pipeline, (ii) a £10 million per annum allocation in Stream 2 investments (e.g. energy storage projects or investments with regeneration benefits) and (iii) the capacity to deliver the level of investment with the two approved framework suppliers in line with Member Agreements. The projection of likely investments in all three streams as follows:

|

Funding Allocation |

2019/2020 £’000 |

2020/2021 £’000 |

2021/2022 £’000 |

2022/2023 £’000 |

2023/2024 £’000 |

|---|---|---|---|---|---|

|

Stream 1 |

40,000 |

60,000 |

80,000 |

100,000 |

120,000 |

|

Stream 2 |

10,000 |

20,000 |

30,000 |

40,000 |

50,000 |

|

Stream 3 |

- |

42,500 |

85,000 |

127,500 |

170,000 |

|

Totals |

50,000 |

122,500 |

195,000 |

267,500 |

340,000 |

Investment relating to commercial premises will be directed towards three streams of activity:

Stream 1

Prime and close to prime commercial real estate investment let on long leases to good covenants which will provide a secure long-term income over and above their ability to pay back the purchase price debt. The minimum target yield for a stream 1 assessment is 5% per investment, excluding MRP and the cost of borrowing.

The contributions from Stream 1 investments will include:

- Yield / profit

- Long term capital uplift

Commercial lease arrangements in relation to the Council’s portfolio are classed as operating leases. International Financial Reporting Standard (IFRS) 9 relates to treatment of various financial instruments. Sundry Debtor Balances are classed as a financial instrument and all financial instruments need to be subject to impairment when the expected recoverable amount is less than the actual amount outstanding. All outstanding amounts relating to leases will be recorded at the net recoverable amount after allowing for an appropriate provision for bad and doubtful debts (If any).

Stream 2

Investment which can generate regeneration or economic development benefits as well as positive financial returns for the Council. Financial returns for the Council may come in the form of increased business rates income, New Homes Bonus where the investment is within the District and residential letting income from Build to Rent developments. The minimum target yield for a stream 2 investment is 2.5%, excluding MRP and the cost of borrowing.

The contributions from Stream 2 investments will include positive financial returns for the Council, and may also include the following:

- Investment loans to 3rd parties

- Investing in climate and environmental initiatives

- Investing in Social Capital

- Redeveloping Council owned assets

- Building homes and commercial premises

- Using public land and buildings to achieve long-term socio-economic development within the District and wider Greater Cambridgeshire Area, as identified in the Local Plan and Appendix 5.

To provide a longer term perspective for Stream 2 investments, the Internal Rate of Return (IRR) may be an appropriate metric to assess the strength of an investment. The IRR is the interest rate at which the net present value of all cash flows arising from an investment is equal to zero.

Stream 3

Investment partnerships with third party developers to deliver new homes that will include:

- Acquisition of 3rd party land

- Include public sector and bank debt

- Incorporation of grants and other funding

- A sharing of risk and reward between partners

The investment assessment criteria for all three streams are shown in Appendix 1 (1a). The minimum target yield for a stream 3 investment is 5%, excluding MRP and the cost of borrowing. IRR may also be appropriate as a measure of an investment’s rate of return.

Prudential Indicators

- The Guidance requires local authorities to develop quantitative indicators that allow Councillors and the public to assess a local authority’s total risk exposure as a result of commercial property investment decisions.

- Local Authorities are required to charge to their revenue account each year a Minimum Revenue Provision (MRP) to make provision for the repayment of debt, as measured by the underlying need to borrow. The MRP should be prudent and, although it is for each authority to determine the amount, the published guidance by the Government is “local authorities should align the period over which they charge MRP to one that is commensurate with the period over which their capital expenditure provides benefits”. Provision has, therefore, been made for MRP in the performance indicators in line with the approved Capital and Treasury Management Strategies and based on the equal instalment method, amortising expenditure equally over the estimated useful life of the asset for which borrowing is required.

- The approved Treasury Management Strategy does, however, confirm that where a loan is made to a wholly owned subsidiary of the Council, the loan is deemed to be secured on the assets of the company. Evidence of the ability to repay the loan will be based on the company’s business plan and asset valuation, and no MRP will be made. Exceptionally, where capital expenditure is part of a loan agreement to other than a wholly owned subsidiary – such as the loan to Cambridge Ice Arena – MRP will be applied in these cases.

- The indicators associated with the Council’s proposed Commercial Property Investment Strategy are detailed below.

Debt to Net Service Expenditure (NSE) Ratio

This indicator measures the gross debt (as cash or loan financing) associated with Commercial Property Investments and loans to third parties as a percentage of the Council’s net service expenditure, where net service expenditure is a proxy for the size and financial strength of a local authority.

|

Debt to NSE Ratio |

621% |

968% |

1,322% |

1,697% |

2,077% |

2,100% |

|

Estimate £’000 |

2019/20 |

2020/21 |

2021/22 |

2022/23 |

2023/24 |

Limit |

|---|---|---|---|---|---|---|

|

Third Party Loans |

78,568 |

91,257 |

90,827 |

90,396 |

89,902 |

- |

|

Commercial Investments |

50,000 |

122,500 |

195,000 |

267,500 |

340,000 |

- |

|

Funding Allocation |

128,568 |

213,757 |

285,827 |

357,896 |

429,902 |

|

|

NSE |

20,701 |

22,089 |

21,627 |

21,086 |

20,701 |

- |

The indicator shows that the debt level proposed by the Strategy will be approximately 21 times the level of the Council’s net revenue budget if the proposed investment in the Strategy is funded solely from cash or loan financing.

Given that the Strategy will take the risk profile of investments into account in the decision-making process and the Council sees property investments as a long-term investment this ratio is reasonable. A maximum limit of 2,100% has been set for this indicator.

Net Commercial Income to NSE Ratio

This indicator measures the Council’s dependence on the income from commercial property investments to deliver core services.

The commercial income will be the gross income from all investments made through the strategy less all operational costs, including the operational costs shown in indicator 8.4.7. All income forecasts should allow for void periods where applicable. The table below identifies gross income:

|

Net Commercial income to NSE Ratio |

15.6% |

21.6% |

33.1% |

45.2% |

54.9% |

55% |

|

Estimate £’000 |

2019/20 |

2020/21 |

2021/22 |

2022/23 |

2023/24 |

Limit |

|---|---|---|---|---|---|---|

|

Third Party Loans |

2,132 |

2,511 |

2,499 |

2,487 |

2,474 |

|

|

Commercial income |

1,107 |

3,350 |

7,195 |

11,042 |

14,344 |

|

|

Total Net Income (less MRP) |

3,239 |

4,765 |

7,148 |

9,533 |

11,372 |

|

|

NSE |

20,701 |

22,089 |

21,627 |

21,086 |

20,701 |

|

The additional income generated from the investments set out within this Strategy will be equivalent to 54.9% of the Council’s Net Service Expenditure by 2023/2024. This ratio is considered reasonable and a maximum limit of 55% has been set for this indicator.

The indicator allows for MRP in accordance with the approved Treasury Management Strategy with the following allowance for each year:

|

Estimate £’000 |

2019/20 |

2020/21 |

2021/22 |

2022/23 |

2023/24 |

|---|---|---|---|---|---|

|

Minimum Revenue Provision |

0 |

1,096 |

2,546 |

3,996 |

5,446 |

Investment Cover Ratio

This indicator measures the total net income from property investments compared to interest expense:

|

Investment cover Ratio |

2.66 |

1.53 |

1.44 |

1.40 |

1.31 |

|

Estimate £’000 |

2019/20 |

2020/21 |

2021/22 |

2022/23 |

2023/24 |

|---|---|---|---|---|---|

|

Net Commercial income |

3,239 |

4,765 |

7,148 |

9,533 |

11,372 |

|

Interest cost |

1,219 |

3,105 |

4,961 |

6,817 |

8,673 |

For commercial investments within Streams 1 to 3, the rate of 2.56% (reflecting current medium to long term PWLB rates) is used to determine the interest expense in the above ratio through to 2023/2024. The interest rates on loans to third parties range from 4.31% to 3.78%. These assumptions will be revised in future years as the size of the portfolio develops.

Loan to Value (LTV) Ratio

This indicator measures the amount of debt compared to the total asset value. In the period immediately after purchase it is normal for the directly attributable costs of purchasing commercial property investments to be greater than the realisable value of the asset (for example, because of non-value adding costs such as stamp duty). Current market advice indicates that commercial property values are expected to remain constant for the foreseeable future, however, borrowings will be repaid.

|

LTV Ratio |

1.00 |

1.02 |

1.02 |

1.03 |

1.03 |

|

Estimate £’000 |

2019/20 |

2020/21 |

2021/22 |

2022/23 |

2023/24 |

|---|---|---|---|---|---|

|

Funding Allocation |

128,568 |

213,757 |

285,827 |

357,896 |

429,902 |

|

Total asset values |

128,298 |

217,622 |

292,817 |

368,011 |

443,142 |

Each year the Council will assess whether assets purchased via the Strategy retain sufficient value to provide security of investment using the fair value model in International Accounting Standard 40: Investment Property. If the fair value of assets is not sufficient to provide security for the capital investment the Strategy will provide detail of the mitigating actions that are being taken, or are proposed to be taken, to protect capital investment. The IST will also provide a liquidity assessment of the portfolio when undertaking the Fair Value assessment.

Target Income Returns (Yield)

This indicator shows the target gross yield for each stream of investment activity and is a measure of the minimum expected return for the property investment portfolio.

|

Target income returns |

2019/20 |

2020/21 |

2021/22 |

2022/23 |

2023/24 |

|---|---|---|---|---|---|

|

Stream 1 |

5% |

5% |

5% |

5% |

5% |

|

Stream 2 |

2.5% |

2.5% |

2.5% |

2.5% |

2.5% |

|

Stream 3 |

5% |

5% |

5% |

5% |

5% |

Gross and Net Income

|

Estimate £’000 |

2019/20 |

2020/21 |

2021/22 |

2022/23 |

2023/24 |

|---|---|---|---|---|---|

|

Gross Income: |

4,324 |

7,217 |

11,182 |

15,126 |

18,523 |

|

Net Income |

3,239 |

4,765 |

7,148 |

9,533 |

11,372 |

The achievement of the target income required from the Investment Strategy will be closely monitored as part of the Council’s budget monitoring process.

Operating Costs

|

Estimate £’000 |

2019/20 |

2020/21 |

2021/22 |

2022/23 |

2023/24 |

|---|---|---|---|---|---|

|

Operating Costs |

261 |

404 |

541 |

654 |

767 |

The above operating costs relate to the cost of acquiring and maintaining the investments made through the Strategy. The costs shown reflect the estimated cost of internal staff, external asset management and a budget for feasibility work to conduct due diligence prior to investment.

Vacancy Levels and Tenant Exposures

|

Estimate £’000 |

2019/20 |

2020/21 |

2021/22 |

2022/23 |

2023/24 |

|---|---|---|---|---|---|

|

Operating Costs |

3% |

3% |

3% |

3% |

3% |

This indicator measures and sets targets for the void periods within the property portfolio.

The target of 3% reflects the strong tenant covenant strengths that will be required under the Stream 1 investment criteria. Void periods will be factored into the financial appraisals as part of the assessment criteria where relevant, therefore this indicator may be revised once investments are made.

Appendix 1 - Property investment stream 1

Objective

The objective of the Stream 1 investment criteria is to establish a framework for the identification of commercial property investments which, if acquired, would contribute to established Business Plan priorities and provide the Council with a positive rental return and capital growth.

The investment criteria are designed to ensure that funds are invested in properties that deliver yield and security commensurate with the Council’s risk appetite.

Each potential investment will be evaluated to ensure the income received is sufficient to provide an acceptable rate of return following the payment of borrowing costs, acquisition costs, management fees and any running costs.

Purchases will take regard of the need to diversify the Council’s property portfolio to manage risks across the entire portfolio.

The Council will procure external advisors to act on its behalf for the acquisition of investments, who will provide pre-purchase reports and building surveys to support the business case. These consultants will be managed by the Commercial Development and Investment Team, who will be responsible for monitoring the service that is provided.

Market Analysis and Background

As with other forms of investment at their most basic level, property investment is a trade-off between risk and return. A traditional well diversified property portfolio (spread across different property sectors and geographical regions) will deliver long term rental and capital growth with relatively low risk. Prime property in the target regions covered by this Strategy will typically provide an initial yield of between 5-7% with the additional prospect of capital growth leading to a higher total return to the Council.

The Strategy will adopt the same underlying principle of diversification in acquiring property investments offering a similar return profile. The three main property sectors will be included (industrial, office and retail) and in turn, these will be additionally diversified on criteria including location, the lease term and lot size. When added to the existing portfolio this will assist in protecting the Councils overall risk and return profile should an individual property investment cease to be income producing (for example, it is undergoing refurbishment or awaiting a new tenant).

Property Acquisition Methodology

Identification, consideration and recommendation of assets suitable for acquisition will be undertaken by the IST in conjunction with outside specialist guidance and professional support, procured in accordance with the Council's established Contract Procedure Rules.

The IST, through the designated Head of Commercial Development & Investment and appointed agents, will undertake a search of the market which will include approaches and introductions of opportunities direct from the sellers, their agents and third parties. Introductions from third party agents will be accepted on a first come first served basis by verbal or written communication to the Head of Commercial Development & Investment.

Investment opportunities will initially be submitted to IST for consideration and subsequently to the Investment Governance Board (IGB). If after the introduction is made, the Council wishes to pursue the purchase further written agreement on the "basis of engagement" and fees will be required.

The use of independent consultants will be required to assess properties prior to bidding and any purchase will be subject to due diligence on all physical, financial and legal aspects of the property to address its suitability as an asset for long term security and growth.

All investments considered for purchase that meet pre-determined criteria and strategy aims (see section 4 below) will undergo qualitative and quantitative appraisal to establish portfolio suitability which will consider rental levels, location, property type, rent review and lease expiry pattern, tenant(s), industry sector, tenure, lease covenants, market exit constraints and physical and environmental factors. In addition, 3rd party advice will be called upon where specialist market knowledge is required. It is recognised that some of the cost of feasibility work and technical appraisal and assessment will be abortive.

Property investment markets are, in general, controlled by national and regional commercial property agencies and establishing links and relationships with several such property agents is the best method of sourcing suitable properties for acquisition. Staffing resources will need to be made available to source suitable property assets for acquisition that match the criteria set under the Strategy. This can be done by both recruitment into the IST team and by employing additional external expertise as required.

All commercially based investments involve risk and, at each stage of the process, the commitments made will be at risk as there can be no guarantee that a fully successful development will be achieved. The terms of the agreement between the parties will seek to mitigate the inherent risks. Moreover, the timing of the exercise can also be a critical factor in achieving optimum success, particularly in terms of market conditions, the state of the national economy and levels of investment confidence within the development industry.

Minimum Investment Criteria

For a Stream 1 property investment to be considered by the IGB for recommendation to Cabinet for approval it must:

- Achieve a minimum weighted score of 100 from the investment criteria matrix shown in Appendix 1 (1a);

- Have a Net Initial Yield of 5% after making allowance for purchase costs;

- Be accompanied by a full business case prepared by the IST.

Each potential property investment will undergo a qualitative and quantitative appraisal, together with a risk assessment, to establish portfolio suitability and the legal and financial implications of the purchase.

The findings of these appraisals will be reported to the IGB as part of the business case. Appendix 1 (1b) details the specific areas that will be included in the business case as a minimum.

All acquisitions, where relevant, will be subject to building and plant survey, independent advice and valuation.

An investment opportunity that does not meet the minimum criteria under investment stream 1 may have separate investment or regeneration benefits and, therefore, may be considered separately under Stream 2 of the strategy.

Risk Management

- Financing Risk: As with all investments, there are risks that capital values and rental values can fall as well as rise. To mitigate against future unfavourable market forces, Stream 1 acquisitions will be made on the basis that the Council is willing and capable of holding property investments for the long term like 35 years +. This will ensure income and capital returns are considered over the long term thereby smoothing out any cyclical economic/property

Where the purchase of a property is reliant on increases in borrowing the business case will factor in fixed rate borrowing costs. By utilising fixed rate borrowing options the Council will be protected from future increases in financing costs. The Council can mitigate the limitations that come with the term commitment characteristic of fixed rate options through using a portfolio of loans of different terms at different rates, as part of its wider Treasury Management Strategy, thereby creating options to ‘recycle’ loans for other purposes, should net disposals of assets held within the Investment Strategy exceed the value of net acquisitions.

- Portfolio Risk – void periods: To mitigate the risk of void periods where the property is either partially or fully vacant, or a tenant has defaulted on its rental obligations, the investment portfolio will be actively managed. The investment criteria specified in the scoring matrix will tend to favour secure property investments like high-quality buildings in prime locations, thus mitigating the risk of void periods on re-letting.

Void periods for commercial investment properties acquired under this Strategy will be monitored, and vacancy levels will be reported to the IGB throughout the year so that they can be actively managed.

Portfolio Management

Newly purchased property acquired under this Strategy would be added to the existing portfolio and the Commercial Development & Investment Team (currently comprising the Head of Commercial Development & Investment, the Delivery & Innovations Officer and the Green Energy Investment Officer), would undertake asset and property management to maintain and improve the performance of an investment property; with established core staff supplemented, as required, by external commercial asset investment/management advisors from approved budgets. This would include ensuring statutory and regulatory compliance, tenant compliance, landlord responsibilities, securing receipt of rents, dealing with voids and insurance matters. The costs associated with these areas would be considered in the financial appraisal for the property acquisition.

The property asset management will be subject to an annual review and incorporated within the Asset Management Plan (Housing Revenue Account) and Corporate Asset Plan (General Fund) which are presented to Full Council annually.

Appendix 1a Investment Criteria Matrix

The IST will score the property against the scoring criteria shown below in order of priority. The minimum score for Stream 1 at least 100 out of a maximum score of 184; this is equivalent to at least the 54th percentile of the maximum. There will, however, be a trade-off between the level of return and the score. For example, a high return would reflect higher risk and consequently a lower score; conversely, a lower level of return would reflect a lower level of risk and a higher score. The Investment Criteria Matrix is comparable with methods used by other local authorities, such as New Forest, Kettering and Redditch, which all broadly follow a format recommended by CIPFA.

The table below shows the suggested scoring criteria to be applied when considering an investment property.

|

Scoring Criteria |

Weighting Factor |

4 (Excellent / very good) |

3 (Good) |

2 (Acceptable) |

1 (Marginal) |

0 (Unacceptable) |

|---|---|---|---|---|---|---|

|

Location |

12 |

Major Prime |

Micro Prime |

Major Secondary |

Micro Secondary |

Tertiary |

|

Tenancy Strength |

10 |

Single tenant with strong financial covenant |

Single tenant with good financial covenant |

Multiple tenants with strong financial covenant |

Multiple tenants with good financial covenant |

Tenants with poor financial covenant strength / vacant |

|

Tenure |

9 |

Freehold |

Lease 125 years plus |

Lease between 50 & 125 years |

Lease between 20 & 50 years |

Lease less than 20 years |

|

Occupiers remaining lease length |

5 |

Greater than 10 years |

Between 7 and 10 years |

Between 4 and 7 years |

Between 2 and 4 years |

Less than 2 years; vacant |

|

Building Quality / obsolescence |

4 |

Newly Built (useful life 50+ years) |

Recently refurbished (within the past 5 years) |

Average condition and likely to continue to be fit for current use for 25+ years |

Aged property with redevelopment potential |

Nearing end of useful life / unlikely to continue when lease expires |

|

Repairing obligations |

4 |

Full repairing and insuring |

Internal repairing – 100% recoverable |

Internal repairing – partially recoverable |

Internal repairing – no recoverable |

Landlord |

|

Lot size

|

2 |

Between £6m and £12m |

Between £4m & £6m or £12m and £18m |

Between £2m & £4m or £18m and £20m |

Between £1m & £2m or £20m & £25m |

Less than £1m or more than £25m |

Investment Criteria Definitions

Location - property is categorised as prime, secondary or tertiary in terms of its location desirability. For example, a shop located in the best trading position in a town would be prime, whereas a unit on a peripheral neighbourhood shopping parade would be considered tertiary.

Tenancy Strength – the financial strength and risk of failure of a tenant determines the security of the property’s rental income. A financially weak tenant increases the likelihood that the property will fall vacant. Rating agencies, such as Dun & Bradstreet are often used to evaluate covenant strength, ranging from “5A” to “HH” to reflect company size based upon worth or equity, and a Composite Credit Appraisal from 1 to 4 to reflect the assessment of the firm’s creditworthiness. The minimum acceptable financial strength for any given tenant will be determined through financial appraisal of company accounts and the use of appropriate methods of risk assessment and credit scoring. To minimise management and risk, the preference will be for single occupancy investments wherever possible.

Tenure – anything less than a freehold acquisition will need to be appropriately reflected in the price. If leasehold, is the lease free from unencumbered/onerous terms? Is the rent periodically reviewed to take into account inflation and upward market movement?

Occupational Lease Length – the lease term will determine the duration of the tenant’s contractual obligation to pay rent. The most attractive investments offer a long lease with a strong tenant covenant. The lease term will reflect any tenant break clauses. The optimum lease length will depend on the sector, with commercial B1 offices typically 7+years and 10+ years for industrial. Retained agents will be expected to qualify the quality of the length lease in their pre-acquisition report.

Building Quality – a brand new or recently refurbished building with an anticipated life of at least 40 years will not usually require capital expenditure for at least 15 years. This is attractive for income investors requiring long term rental income with the minimum of ongoing capital expenditure.

Repairing Obligations – under a Full Repairing & Insuring Lease (FRI), the tenant is responsible for the building’s interior and exterior maintenance / repair. The obligation is limited to the building’s interior under an Internal Repairing & Insuring Lease (IRI). The preference will be to favour FRI terms (or FRI by way of service charge i.e. all costs relating to occupation and repairs are borne by the tenants and administered through a service charge).

Lot Size – to maintain portfolio balance the preference will be for no single property investment to exceed £12m for a single let property.

In addition to the above criteria the IGB should, when assessing the merits of an investment, specifically consider compatibility with all SCDC policies on matters relating to use such as: -

- Alcohol or tobacco production or sale;

- Animal exploitation;

- Environmentally damaging practices;

- Gambling;

Appendix 1b - Stream 1 Business Case

The IST will prepare a business case for Stream 1 investments where the minimum weighted score target has been met. The business case will include as a minimum:

Financial Appraisal

A detailed financial appraisal setting out the projected income and costs associated with a potential acquisition along with an assessment of the proposed financing options and associated risks and considerations. This will include an assessment of the net yield over various scenarios up to a 50-year period, and include the following inputs:

- anticipated void periods at the end of the initial and subsequent occupiers lease(s);

- anticipated Capital Expenditure required by the Landlord, taking into account the age and condition of the premises and Landlords repairing obligations;

- assumptions in the approved Capital and Treasury Management Strategies.

Lease Classification

A lease should be classified, for accounting purposes, as an operating lease rather than finance lease, to ensure that all rental income can be treated as revenue income (rather than a mix of capital receipt and revenue income). Operating leases are those where the risks and rewards of ownership are retained by the lessor (the Council) and must meet certain criteria. The main criteria being that the lease term should not be for the major part of the property’s economic life and at the start of the lease, the total value of minimum lease payments (rents) should not amount to a significant proportion of the value of the property.

Risk Management Assessment

A detailed risk assessment of the potential purchase, including but not limited to:

- Specific risks associated with individual assets;

- Tenant default on rental payment (covenant risk);

- Risk of failure to re-let (void risks);

- Costs of ownership and management;

- Differing lease structures (for example, rent review structure, lease breaks);

- Sector risk (portfolio spread);

- Provide an exit strategy financial assessment as a ‘worse case’ scenario;

- Liquidity assessment;

- LTV ratio assessment.

Market Risks, including risks of structural change or market failure, which may affect the market as a whole or particular subsectors or groups of property:

- Illiquidity upon sale (for example, lot size, transaction times, availability of finance);

- Failure to meet market rental expectations (forecast rental growth);

- Failure to meet market yield expectations (forecast yield shift);

- Risk of locational, economic, physical and functional depreciation through structural change;

- Risks associated with legislative change (for example, planning or changes in fiscal policy).

Portfolio Assessment

An assessment to establish suitability against the Council’s existing property portfolio which will consider rental levels, location, property type, rent review and lease expiry patterns, industry sector, tenure, lease covenants, market exit constraints and physical and environmental factors.

Report on Title

To confirm ownership.

Appendix 2 - Property investment stream 2

Objective

The objective of the Stream 2 investment criteria is to establish a framework for the identification of properties or land for redevelopment. These opportunities may deliver placemaking or economic development benefits, as defined in our Business Plan, as well as positive financial returns for the Council in the form of future revenue income streams or capital uplifts. Future revenue income streams could include increases in retained business rates income and New Homes Bonus.

Developed properties may be retained for the benefit of their long-term rental income and will become an investment asset after completion. The decision on whether these investments would meet the overall objectives of this Strategy will be informed by a financial appraisal as described in Appendix 1.

The Stream 2 investment criteria will be designed to ensure that the financial returns delivered from investments are commensurate with the deemed levels of associated risk. A higher risk investment will therefore require the delivery of greater financial returns.

Market Analysis and Background

Stream 2 investment opportunities could come in a diverse range of forms. Examples include, but are not limited to:

- Investing in climate and environmental initiatives, further exploiting and supporting green energy generation and maximising energy efficiency;

- Investing in Social Capital;

- Redeveloping Council owned assets;

- Building homes and commercial premises;

- Using public land and buildings to achieve long-term socio-economic development within the District and wider Greater Cambridgeshire Area, as identified in the Local Plan and Appendix 4 of this Strategy.

As with other forms of investment there is a trade-off between risk and return. Given the more speculative nature of this type of investment activity the risks associated with this type of investment may, in some cases, be higher than those associated with Stream 1 activity. It may be possible to share risks and rewards of Stream 2 activities with adjoining councils and other public sector and private sector partners.

The assessment criteria for Stream 2 activities needs to be agile enough to allow significantly different schemes to be assessed using the same overarching principles.

For a Stream 2 property investment to be considered by the IGB it must:

- Deliver a rate of return commensurate with the deemed level of risk associated with the investment;

- Be accompanied by a full business case prepared by the IST, and other officers where

The investment opportunities considered under Stream 2 could vary significantly and, due to the speculative nature of some schemes, there will be higher risks attached to some investment opportunities.

Each potential Stream 2 investment will undergo a qualitative and quantitative appraisal and risk assessment to establish the financial returns, financial and legal implications and risks associated with the purchase. The findings of these appraisals will be reported to the IGB as part of the business case.

An investment opportunity that does not meet the minimum criteria under investment stream 2 may have separate investment or regeneration benefits and, therefore, may still be considered for progression, however, decision making in this case is to be reserved to the Cabinet. For investments where there is a variable revenue stream, such as some energy projects, or a long time gap between investment and first revenue, such as development projects, alternative valuation options, such as the Internal Rate of Return (IRR) may be appropriate as a measure of an investment’s rate of return.

Property Acquisition/Development Methodology

Identification, consideration and recommendation of assets suitable for acquisition and/or development will be undertaken by the designated Head of Commercial Development & Investment in conjunction with internal resource and outside specialist guidance and professional support, as required, procured in accordance with the Council's established Contract Procedure Rules. These investment opportunities will initially be submitted to IST for consideration and subsequently to the IGB.

All investments considered for purchase will undergo qualitative and quantitative appraisal to establish portfolio suitability and risks. In addition, 3rd party advice will be called upon where specialist market knowledge is required. It is recognised that some of the cost of feasibility work and technical appraisal and assessment will be abortive.

All commercially based investments and/or developments involve risk and, at each stage of the process, the commitments made will be at risk as there can be no guarantee that the investment will be secured, or a fully successful development will be achieved. The terms of the agreement between the parties will seek to mitigate the inherent risks. Moreover, the timing of the exercise can also be a critical factor in achieving optimum success, particularly in terms of market conditions, the state of the national economy and levels of investment confidence within the development industry.

Green Energy Projects

The approved Business Plan 2019-2024 identifies the following Focus, Actions and Measures which relate to green energy investments within the ‘Green to our core’ priority:

|

Focus |

Action |

Measures |

|---|---|---|

|

We will become a Zero Carbon Council

|

In recognition of the global climate and health emergency, develop an action plan to deliver a zero-carbon future for South Cambridgeshire |

|

|

We will increase green energy generation and promote environmentally friendly energy consumption |

Explore opportunities for renewable energy generation and maximise the energy efficiency of the Council offices and estate. Provide support and guidance to community groups for projects that will reduce reliance on fossil fuels and promote behaviour change to help achieve the zero-carbon target. Look into how electric vehicle charging points can be delivered in the district. |

|

The Investment Strategy will develop projects identified in the Green Energy Programme, which is responsible for co-ordinating transformation activities within the South Cambridgeshire District Council commercial estate and assess these using the same criteria as other Stream 2 investments.

Minimum Investment Criteria

In addition to the investment criteria matrix in Appendix 1 (1a), Stream 2 investments will be assessed for their strategic fit against the Objectives and Focus Areas contained within the 2019-2024 Business Plan.

The IGB will from time to time advise the target scores for the business plan objectives, and the weighting to be given to individual focus areas within each business plan area

Risk Management

- Financing Risk: As with all investments, there are risks that capital values, rental values and development values can fall as well as rise. Where the acquisition or development is reliant on increases in borrowing the business case will factor in fixed rate borrowing costs commensurate with the anticipated holding period of the asset. By utilising fixed rate borrowing options the Council will be protected from future increases in financing costs.

Financial returns from Stream 2 activities may come in the form of capital receipts either in place of or in addition to revenue returns. This would need to be considered carefully as part of the overall Strategy given the requirement to achieve net revenue returns of 2.5% from the investment strategy overall.

Business Case

The IST will prepare a business case for Stream 2 investments where the minimum weighted score target has been met (Appendix 6).

The minimum score target will be determined by the Head of Commercial Development & Investment and their Team, in consultation with the Lead Member for Finance, once Business Plan objectives and focus areas have been finalised.

Example: Enterprise Zone Investment/Development – Stream 2 Scheme Fit Against Business Plan

|

Draft Business Plan Areas |

Score |

Focus Area |

Actions |

Measures |

|---|---|---|---|---|

|

1. Growing local businesses and economies |

33% |

|

|

|

|

2. Housing that is affordable for everyone to live in |

0% |

- |

- |

- |

|

3. Being green to our core |

40% |

|

|

|

|

4. A modern and caring Council |

40% |

|

|

|

Appendix 3 - Property Investment stream 3 – Investment Partnerships

Objective

The objective of the Stream 3 investment criteria is to establish a framework for the identification of properties or land for development of new homes through Investment Partnerships. These opportunities may deliver regeneration or economic development benefits as well as positive financial returns for the Council in the form of future revenue income streams or capital uplifts. Future income streams may include:

- Rental income from Council Housing (HRA Affordable Homes);

- Rental income from Private Rented Sector Housing (PRS) through Ermine Street Housing;

- Capital receipts from Intermediate Home Ownership staircasing;

- Capital receipts from Right to Buy;

- Increases in retained business rates;

- New Homes Bonus.

Developed properties may be retained for the benefit of their long-term rental income and will become an investment asset after completion. The decision on whether these investments would meet the overall objectives of this Strategy will be informed by a financial appraisal as described in Appendix 1.

The Stream 3 investment criteria will be designed to ensure that the financial returns delivered from investments are commensurate with the deemed levels of associated risk. A higher risk investment will therefore require the delivery of greater financial returns.

Market Analysis and Background

Stream 3 Investment Partnerships could come in a diverse range of forms. Examples include, but are not limited to:

- Building homes and commercial premises;

- Using public land and buildings to achieve long-term socio-economic sustainability for the District and wider Greater Cambridgeshire Area, as identified in the Local Plan and Appendix A4 of this strategy.

As with other forms of investment there is a trade-off between risk and return. Given the more speculative nature of this type of investment activity the risks associated with this type of investment may, in some cases, be higher than those associated with Stream 1 activity. However, these risks and rewards would be shared with the investment partner.

The assessment criteria for Stream 3 activities needs to be agile enough to allow significantly different schemes to be assessed using the same overarching principles.

Minimum Investment Criteria

For a Stream 3 property investment to be considered by the IGB it must:

- Deliver a rate of return commensurate with the deemed level of risk associated with the investment;

- Be accompanied by a full business case prepared by the IST, and other officers where relevant.

The scoring matrix for Stream 3 investments will be based on the targets for Stream 2 investments. Schemes with higher risks will be expected to deliver higher levels of return to cover the risk considerations, and only schemes that deliver the assessed rate of return will pass the minimum assessment criteria.

Each potential Stream 3 investment will undergo a qualitative and quantitative appraisal and risk assessment to establish the financial returns, financial and legal implications and risks associated with the purchase. The findings of these appraisals will be reported to the IGB as part of the business case.

An investment opportunity that does not meet the minimum criteria under investment stream 3 may have separate investment or regeneration benefits and, therefore, may still be considered for progression, however, decision making in this case is to be reserved to the Cabinet rather than the IGB. For investments where there is a variable revenue stream, such as some energy projects, or a long time gap between investment and first revenue, such as development projects, alternative valuation options, such as the Internal Rate of Return (IRR) may be appropriate as a measure of an investment’s rate of return.

Acquisition/Development Methodology

Identification, consideration and recommendation of assets suitable for acquisition and/or development will be undertaken by the designated Head of Commercial Development & Investment in conjunction with internal resource and outside specialist guidance and professional support, as required, procured in accordance with the Council's established Contract Procedure Rules. These investment opportunities will initially be submitted to IST for consideration and subsequently to the IGB.

All investments considered for purchase will undergo qualitative and quantitative appraisal to establish portfolio suitability and risks. In addition, 3rd party advice will be called upon where specialist market knowledge is required. It is recognised that some of the cost of feasibility work and technical appraisal and assessment will be abortive.

All commercially based investments and/or developments involve risk and, at each stage of the process, the commitments made will be at risk as there can be no guarantee that the investment will be secured or a fully successful development will be achieved. The terms of the agreement between the parties will seek to mitigate the inherent risks. Moreover, the timing of the exercise can also be a critical factor in achieving optimum success, particularly in terms of market conditions, the state of the national economy and levels of investment confidence within the development industry.

In addition to the investment criteria matrix in Appendix 1 (1a), Stream 3 investments will be assessed for their strategic fit against the Objectives and Focus Areas contained within the 2019-2024 Business Plan.

The IGB will from time to time advise the target scores for the business plan objectives, and the weighting to be given to individual focus areas within each business plan area.

Risk Management

- Financing Risk: As with all investments, there are risks that capital values, rental values and development values can fall as well as rise. Where the acquisition or development is reliant on increases in borrowing the business case will factor in fixed rate borrowing costs commensurate with the anticipated holding period of the asset. By utilising fixed rate borrowing options the Council will be protected from future increases in financing costs.

Financial returns from Stream 3 activities may come in the form of capital receipts either in place of or in addition to revenue returns. This would need to be considered carefully as part of the overall Strategy given the requirement to achieve net revenue returns of 2.5% from the investment strategy overall.

Business Case

The IST will prepare a business case for Stream 2 investments where the minimum weighted score target has been met (Appendix 6).

The minimum score target will be determined by the Head of Commercial Development & Investment and their Team, in consultation with the Lead Member for Finance, once the Business Plan objectives and focus areas have been finalised.

Appendix 4 - Governance

- Full council

- Scrutiny & Overview

- Cabinet

- Investment Governing Board (approves recommendations within approved scheme of delegations, with recommendations to Council as appropriate)

- Chief Executive Officer

- S151 Officer

- Leader

- Deputy Leader/ Lead Cabinet Member for Finance

- Investment Selection Team (develops Stream 1, 2 & 3 investment recommendations for IGB approval)

- Chief Executive Officer

- S151 Officer

- Head of Commercial Development & Investment

- Director

- Monitoring Officer

- Commercial Development and Investment team

- Corporate PPM

- Stream 1 investment activity

- Stream 2 investment activity

- Stream 3 investment activity

- Delivery

Appendix 5 - Investment area

Investment Target Area

The investment target area outside of the Local Plan boundary follows the definition of the Greater Cambridge commuting pattern, as identified in the Cambridgeshire and Peterborough Independent Economic Review (September 2018).

- Total commuters: 143,818

- Total inflow: 54,643

Appendix 6 - Stream 2 and 3 Business case outlines

The business case will include the following as a minimum:

Reasons - Why is the investment needed?

Options - What are the options available?

Benefits - What would be the benefits of the investment? How would it help deliver the Business Plan objectives?

Investment Appraisal - A detailed financial appraisal setting out the projected income and costs associated with a potential acquisition along with an assessment of the proposed financing options and associated risks and considerations.

Risk Management Assessment - A detailed risk assessment of the potential investment, including mitigation measures that can be employed:

- Specific risks associated with the proposed investment:

- Risk of failure (sales / letting void risks)

- Costs of ownership and management

- Differing ownership structures (for example, wholly owned subsidiaries).

- Sector risk (portfolio spread)

- Provide an exit strategy financial assessment as a ‘worse case’ scenario

- Liquidity assessment

- LTV ratio assessment

Market Risks, including risks of structural change or market failure, which may affect the market as a whole or particular subsectors or groups of property:

- Illiquidity upon sale (for example, lot size, transaction times, availability of finance)

- Failure to meet market value expectations (forecast value growth)

- Failure to meet market yield expectations (forecast yield shift)

- Risk of locational, economic, physical and functional depreciation through structural change

- Risks associated with legislative change (for example, planning or changes in fiscal policy)

Portfolio Assessment - An assessment to establish suitability against the Council’s existing property portfolio which will consider rental levels, location, property type, rent review and lease expiry patterns, industry sector, tenure, lease covenants, market exit constraints and physical and environmental factors.

Legal

- Report on title (to confirm ownership)

- Options for legal structures (for example, use of wholly owned subsidiaries)

- Advice on SDLT and VAT linked to use of legal structure options

Estimated Timescale

- Proposed start date

- Estimated end date

- Duration

Estimated project resources

- Identify role and name of officers

- Estimate the demand on officer time

- Identify resource gaps and whether these can be met

- Identify external resources required and estimated budget cost